Abc Costing Might Lead to Which of the Following

It also improves performance management policies and allows for those involved to make better decisions because their information is more accurate. The main goal of using the activity-based costing method is to increase the profitability and overall performance of an organization.

Lead Time Meaning Importance How To Improve And More Accounting And Finance Financial Management Digital Marketing Strategy

The ABC method does this by identifying accurate overhead costs and cost drivers leading to more streamlined business processes.

. The manufacturing industry first applied ABC as a costing method. C raising the selling price of low-volume products. Which of the following is NOT likely to be a cost driver of activities associated with determining product cost.

B increasing the sales price of high-volume products. D raising the selling price of low-volume products. ABC costing might lead to.

The ABC system of cost accounting is based on activities. Which of the following is not likely to be a cost driver of activities associated with determining product cost. The Advantages of Activity Based Costing.

Activity-based costing ABC is a costing method that emphasizes on activities. It distributes overhead costs into different production-related activities. Raising the sale price of low-volume products.

ABC costing might lead to. Using traditional costing instead of ABC costing might lead to all of the following except A cutting back on high-volume products that appear unprofitable. You probably also could think of additional ways to allocate Justins wages.

In simple terms activity-based costing helps you see how your products and services related to your overhead costs. But the concept gained popularity and many other industries continue to use it today. ABC costing might lead to which of the following.

Describe activity-based costing and calculate the cost of a job using ABC concepts 71 All of the following describe an ABC system except A ABC systems may only be used by service companies. Activity based costing for companies is all about devising the appropriate pricing strategy for identifying product costing product line profitability analysis target costing and service pricing. It treats activities as fundamental cost objects and uses the cost of these activities for compiling the costs of products and other cost objects.

Activity-based costing and management. Diverse cost drivers are used. Cost of the automobile engines Using traditional costing instead of ABC costing might lead to all of the following except expanding low-volume products that appear profitable cutting back on high-volume products that appear unprofitable raising the selling price of low-volume products raising the selling price of high-volume products.

Activities and their cost drivers. Identification of non-value added cost. Asked Jan 10 2019 in Business by Natalie.

ABC systems use a two-stage approach that is similar to the structure of traditional cost systems such as job order costing and process costing. B raising the selling price of high-volume products. D raising the selling price of high-volume products.

ABC is one of the most important innovations in the field of cost and management accounting Bjornenak and Mitchell 1999. Analytical Thinking Learning Outcome. For example if 50 per cent ofthe ticket sales were for Avatar you might allocate 50 per cent of Justins wages to Avatar.

B ABC systems can create more accurate product costs. All of the following are activities in an activity-based costing system that determine the cost of a manufactured product except for accounting Which of the following statements is TRUE regarding activity-based costing systems. Expanding low-volume products that appear profitable.

C cutting back on high-volume products that appear unprofitable. Unlike traditional costing methods it assigns the cost of each business activity to each. Using a company-wide overhead rate rather than activity-based costing might lead to which of the following problems.

ABC costing might lead to. 33 Using traditional costing instead of ABC costing might lead to all of the following except A expanding low-volume products that appear profitable. In ABC system a cost center is established for each cost driver and identification measurement and control of.

Activity based costing is the process of assigning indirect costs in the form of salaries and utilities to different products and services. Raising the sale price of high-volume products. B expanding low-volume products that appear profitable.

The cost of a product is built up from the cost of specific activities that are undertaken to manufacture it. Following are the three key areas of ABC. Activity-Based Costing ABC likewise enhances product costing by assigning the sources of costs to their originating.

D decreasing high-volume products that appear to be unprofitable. No matter how we allocate Justins wages his wages would not be directly traceable to one of. Raising the sale price of high-volume products.

C increasing low-volume products that appear to be profitable. Overhead is allocated to products in ABC. Activity based costing differs from traditional product costing in which of the following ways.

Activity-based costing is a process for computing production costs. Raising the sale price of low-volume products. C ABC systems are more complex and costly than.

Activities-based costing ABC costing might lead to. It uses the costs of those activities as building blocks for compiling the indirect costs of products and other cost objects. ABC is a procedure that applies overhead allocation to the products that utilize those activities allowing it to be more exact than traditional allocation.

Raising the sale price of low-volume products. Activity-based costing ABC is a method of assigning overhead and indirect costssuch as salaries and utilitiesto products and services. It provides a more accurate cost per unit.

The Activity-Based Costing component allocates process quantities based on resource and process drivers allowing you to define cost allocation more exactly along the Value Added Chain that is possible with overhead rates. Estimated costs are used. A increasing the sales price of low-volume products.

Cutting back on high-volume products that appear unprofitable. When all direct and indirect costs are allocated to a product managers begin to. Because there is more accuracy in the costing using ABC can help provide better pricing and sales strategies.

Standard Costing And Abc A Coexistence Strategic Finance Financial Management Finance Accounting And Finance

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Cost Accounting Accounting Financial Freedom Quotes

Working Capital Vs Term Loan All You Need To Know Accounting Education Accounting And Finance Accounting Basics

Procurement Transformation Management Skill In 2021 Supply Management Management Skills Business Model Canvas

Due Diligence Process Types Checklists Diagrams Checklist Template Checklist Process Flow Chart

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Cost Accounting Accounting Financial Freedom Quotes

Mcgraw Hill Irwin Copyright C 2008 By The Mcgraw Hill Companies Inc All Rights Reserved Supplementary Slides Activity Activities Cost Accounting Abc Does

Activity Base Costing Abc Details Knowledge Of What Is Activity Base What Activities Abc Activities Abc

Pin On Strategy Marketing Sales

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Cost Accounting Financial Freedom Quotes Presentation Deck

Acct 346 Final Exam 1 Tco 4 Assumptions Underlying Cost Volume Profit Analysis Include All Of The Following Except Points 5 In 2021 Final Exams Analysis Exam

Safety Stock Meaning Importance Formula And More Safety Stock Accounting And Finance Economic Order Quantity

Abc Accounting Model Visual Charts Ppt Template Of Activity Based Costing Presentation Business Budget Template Bookkeeping Templates Abc Activities

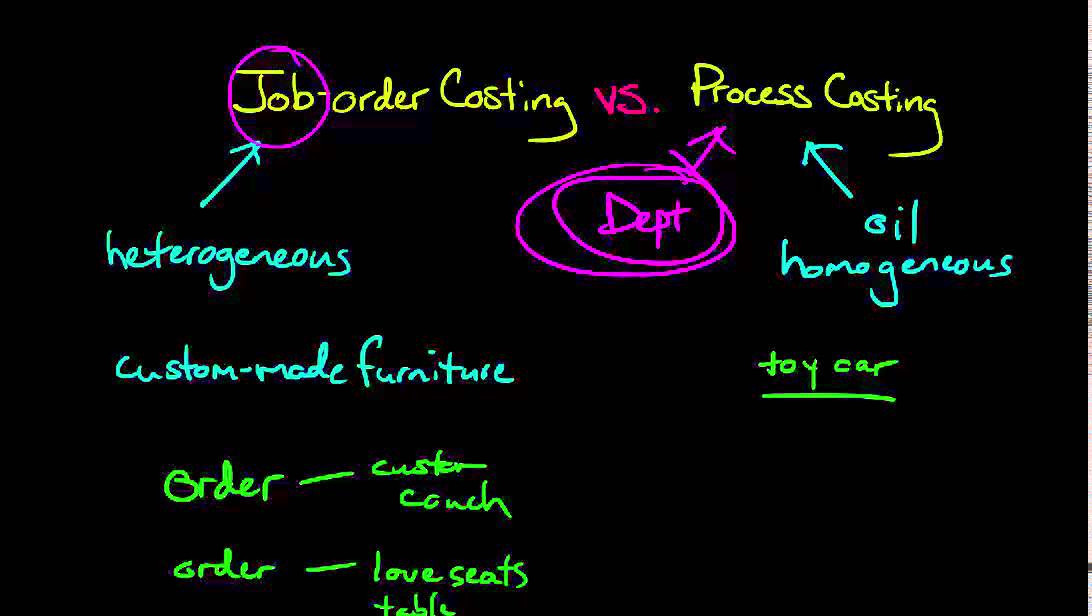

Tsedenya Gebreyesus In This Video He Explains And Goes Into Details About The Differences Of Job Order Costing And Process Costing He Job Relatable Process

Cost Allocation Meaning Importance Process And More Accounting Education Learn Accounting Bookkeeping Business

Subordinated Debt Meaning Example Risk And More Economics Lessons Accounting And Finance Debt

Activity Based Costing Accounting Principles Accounting And Finance Financial Strategies

Comments

Post a Comment